Another Cannabis Business Hit Hard By I.R.C. Section 280E In U.S. Tax Court

I.R.C. § 280E disallows all trade or business expense deductions for a cannabis business even though the cannabis business operates legally under state law. As more “280E Tax Audits” make their way up to the U.S. Tax Court, various creative arguments have been made challenging the constitutionality and legality of § 280E. A recent such case where the U.S. Tax Court issued an opinion is Northern California Small Business Assistants Inc. v. Comm’r, 153 T.C. No. 4 (2019).

Northern California Small Business Assistants Inc.

Northern California Small Business Assistants Inc. (“NCSBA”) is a California medical marijuana dispensary that was selected for audit for the 2012 tax year. The IRS agent in carrying out the mandate of § 280E determined a deficiency of over $1.2 million and applied an accuracy-related penalty of $252,842.

NCSBA petitioned the Tax Court, contending that its operations are legal under California law and presenting three novel arguments. First, NCSBA argued that Code Sec. 280E imposes a gross receipts tax as a penalty in violation of the Eighth Amendment. Second, NCSBA argued that the text of § 280E tracks that of § 162, which allows for all ordinary and necessary business expense deductions, suggesting that § 280E limits only § 162 deductions and permits others – specifically, taxes under § 164 and depreciation under § 167. Finally, NCSBA argued that § 280E refers to “trafficking” and therefore does not apply to marijuana businesses operating legally under state law.

The Tax Court rejected all of NCSBA’s arguments. With respect to NCSBA’s Eighth Amendment argument, the Tax Court ruled that, unlike in other contexts where a financial burden was found to be a penalty, disallowing a deduction from gross income is not a punishment. In the court’s view, § 280E was enacted under Congress’s clear authority to tax gross income and is directed at persons who operate a business in violation of state or federal law.

Next, the Tax Court found that § 280E is not limited to trade or business deductions because the plain language of § 280E states that “no deduction or credit shall be allowed” to businesses that traffic in controlled substances. The court noted that § 261 provides that “no deduction” is allowed for items specified in part IX of subchapter B, and § 280E is in part IX. Similarly, § 161 provides that the deductions in part VI of subchapter B, including the deductions in § 164 and § 167, are allowed subject to the exceptions in part IX. Thus, the court found that, clearly, § 164 and § 167 are limited by the exceptions in part IX, including § 280E.

Finally, the Tax Court rejected NCSBA’s argument that the word “trafficking” in § 280E implied that the statute does not apply to a business operating legally under state law. The court noted that it has rejected that argument in several previous cases and that NCSBA offered no compelling reason to overrule those decisions. The court concluded that its precedent is unambiguous and that Congress, not the courts, would need to carve out an exception in § 280E for businesses that operate legally under state law.

The Anti-Federal U.S. Climate

The Federal Controlled Substances Act (“CSA”) 21 U.S.C. § 812 classifies marijuana as a Schedule 1 substance with a high potential for abuse, no currently accepted medical use in treatment, and lack of accepted safety for use under medical supervision. Although you can still face federal criminal charges for using, growing, or selling weed in a manner that is completely lawful under California law and other states that have legalized cannabis, the federal authorities in the past have pulled back from targeting individuals and businesses engaged in medical marijuana activities. This pull back though has no impact on the IRS which will likely start in 2019 to more aggressively target cannabis businesses with audits.

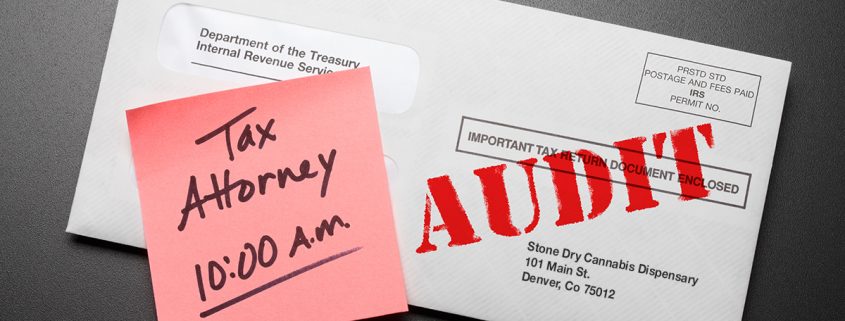

Risk Of Getting A Big Tax Bill From IRS That You Cannot Pay

Generally, businesses can deduct ordinary and necessary business expenses under §162. This includes wages, rent, supplies, etc. However, in 1982 Congress added § 280E. Under § 280E, taxpayers cannot deduct any amount for a trade or business where the trade or business consists of trafficking in controlled substances…which is prohibited by Federal law. Marijuana, including medical marijuana, is a controlled substance. What this means is that dispensaries and other businesses trafficking in marijuana have to report all of their income and cannot deduct rent, wages, and other expenses, making their marginal tax rate substantially higher than most other businesses. A cannabis business that has not properly reported its income and expenses and not engaged in the planning to minimize income taxes can face a large liability proposed by IRS reflected on a Notice Of Deficiency or tax bill.

This risk should be risk posing the greatest challenge to any cannabis business as the Federal taxation of cannabis businesses is consistent in all states and not dependent on whether local Federal prosecutors are aggressive in enforcing the illegality of cannabis or the banks unwilling to do business with the cannabis industry. This unexpected liability can put you out of business so it is important to secure qualified tax counsel to be proactive with tax planning to minimize taxes and to defend you in any tax examinations, appeals or litigation with the IRS.

What Should You Do?

While more States are legalizing cannabis, risks to the cannabis industry still exist. Considering the risks of cannabis you need to protect yourself and your investment. Level the playing field and gain the upper hand by engaging the cannabis tax attorneys at the Law Offices Of Jeffrey B. Kahn, P.C. located in Orange County (Irvine), the Inland Empire (including Ontario and Palm Springs) and other California locations. We can come up with solutions and strategies to these risks and protect you and your business to maximize your net profits. And if you are involved in crypto currency, check out what a bitcoin tax attorney can do for you.

Follow

Follow Follow

Follow