Business Transactions

New Mexico Legalizes Psilocybin (“Magic Mushrooms”) Therapy

/

0 Comments

On April 7, 2025, New Mexico Governor Michelle Lujan Grisham…

FinCEN Issues Final Rule Limiting Reporting Requirements in Connection with Beneficial Ownership Information Reporting Deadlines under the Corporate Transparency Act

“This is a victory for common sense,” said U.S. Secretary…

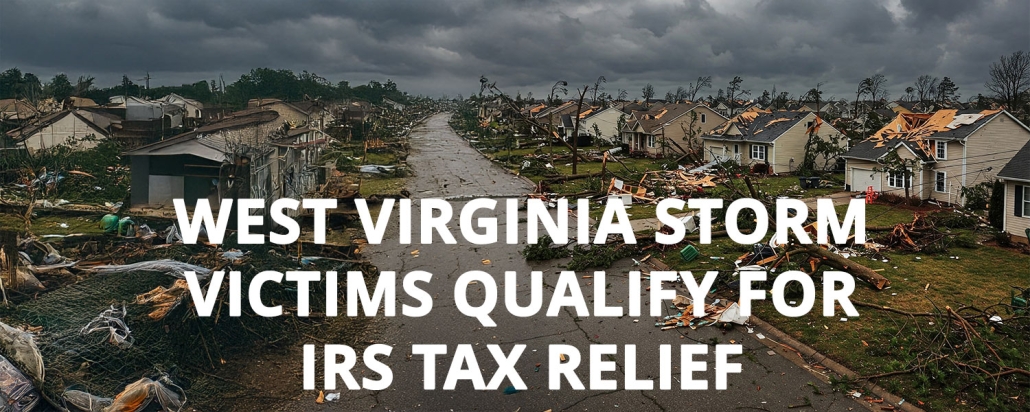

West Virginia Storm Victims Qualify For IRS Tax Relief

On March 14, 2025 the Internal Revenue Service (IRS) announced…

FinCEN Immediately Suspending Fines or Penalties in Connection with Beneficial Ownership Information Reporting Deadlines under the Corporate Transparency Act

“This is a victory for common sense,” said U.S. Secretary…

FinCEN Not Issuing Fines or Penalties in Connection with Beneficial Ownership Information Reporting Deadlines pursuant to the Corporate Transparency Act

Requirement For Banks & Financial Institutions To Report…

A Reimagined IRS Under President Donald Trump And Elon Musk – What Should Taxpayers Do Now?

It is no secret that the IRS is under scrutiny by DOGE and that…

District Court Reinstates Corporate Transparency Act Enforcement

Requirement For Banks & Financial Institutions To Report…

Can You Go To Jail For Not Filing Tax Returns? Beware this can happen to you.

A man who did not file tax returns for 4 years in a row pleaded…

Now That Pam Bondi Is Serving As Attorney General In Trump’s Second Term, How Will The U.S. Attorneys’ Office Support Or Hinder The Cannabis Industry?

During President Trump’s 2016 campaign, he supported medical…

Six Common Myths About The Dreaded IRS Tax Audit

Filing taxes is punishment enough without the vague threat of…

Supreme Court Allows Corporate Transparency Act Enforcement

Requirement For Banks & Financial Institutions To Report…

Jews Granted Minority Status By U.S. Department Of Commerce, Opening Access To Billions In Benefits

In a landmark agreement, the U.S. Department of Commerce during…

Follow

Follow Follow

Follow