Despite Continued Government Shutdown, Some IRS Employees Are Being Called Back To Work

Despite Continued Government Shutdown, Some IRS Employees Are Being Called Back To Work

Temporary funding for the IRS for fiscal year 2019 expired at midnight on December 21, 2018. We previously reported how the government shutdown is impacting IRS operations – click here. That initial contingency plan contemplated that the shutdown would last no more than 5 days and involved furlough of 88% of the IRS workforce (totals approximately 87,000) leaving only 9,946 that are allowed to continue working.

Under an updated contingency plan covering the upcoming filing season, the IRS will recall 57% of its workforce to handle tax season duties increasing the number of IRS employees to 46,052 that are now allowed to work. The new plan will allow the IRS to process paper and electronic returns and issue refunds to taxpayers and adhere to its commitment that tax season will start on January 28, 2019 despite an ongoing government shutdown.

The date when funding will be restored by Congress has not been established but under plans established by each Federal agency, as the lapse in funding continues more Federal government functions will be shutdown.

The Anti-Deficiency Act.

Overriding each Federal agency’s plan is the Anti-Deficiency Act, 31 U.S.C. §1341, which provides that in the absence of appropriated funds no obligation can be incurred except for the protection of life and property, the orderly suspension of operations, or as otherwise authorized by law. This means that absent an appropriation, many Federal employees are prohibited from working, even on a volunteer basis, “except for emergencies involving the safety of human life or the protection of property”. 31 U.S.C. §1342. Accordingly, each Federal agency must designate those employees whose work is necessary to sustain legal operations essential to the safety of human life and the protection of property.

Department Of Justice’s Contingency Plan.

The Department of Justice has issued guidance, which gives priority to continuing work on criminal cases. Consequently, no employees in the Tax Division of the Department Of Justice will be authorized to work on CIVIL MATTERS during a lapse in appropriations.

Updated Contingency Plan Of The IRS.

The following activities of IRS that will continue which are necessary for safety of human life or protection of government property that continue to be operational at IRS are:

- Continuing to complete and test upcoming filing year programs

- Processing electronic returns, up to the point of refund

- Processing paper tax returns through “batching”

- Processing remittances; and

- Maintaining criminal law enforcement operations.

The IRS will also be opening its call sites and responding to taxpayer questions; however, all IRS audit and examination functions and nonautomated collections will continue to be put on hold during the shutdown.

When funds are appropriated to the IRS, furloughed employees will return to work (they are expected to return within four hours after the reactivation is announced if it occurs on a scheduled work day).

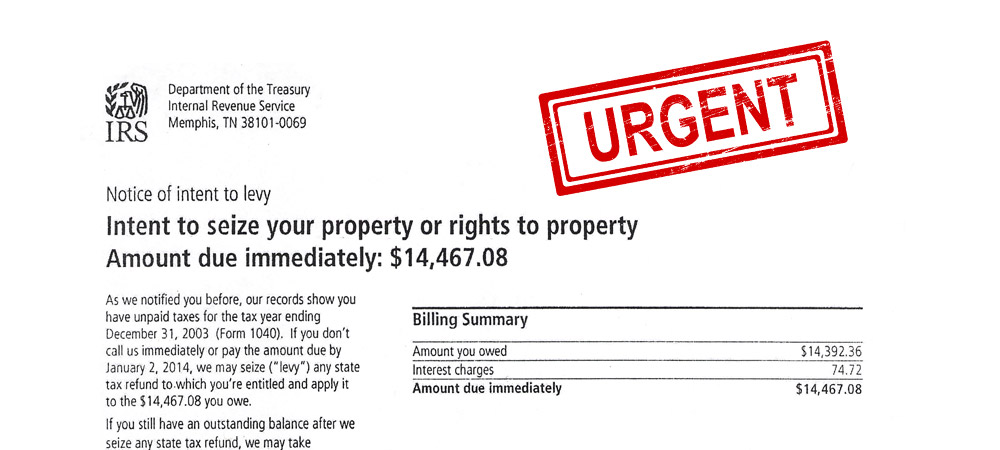

An Opportunity For Taxpayers Who Owe The IRS.

Do not think that if you owe the IRS your tax problem will disappear because the IRS is not fully operational. Instead you should be utilizing this valuable time to get yourself prepared so that when IRS re-opens for business, you are ready to make the best offer or proposal to take control of your outstanding tax debts.

As a prerequisite to any proposal to the IRS, you must be in current compliance. That means if you have any outstanding income tax returns, they must be completed and submitted to IRS. Also, if you are required to make estimated tax payments, you must be current in making those payments. Fortunately, as we are now in 2019, taxpayers who expect to owe for 2018 should have their 2018 income tax returns done now so that the 2018 liability can be rolled over into any proposal and the requirement to make estimated tax payments will now start for 2019.

The take away from this – use the Federal government’s downtime to your advantage to prepare for the future.

What Should You Do?

You know that at the Law Offices Of Jeffrey B. Kahn, P.C. we are always thinking of ways that our clients can save on taxes. If you are selected for an audit, stand up to the IRS by getting representation. Tax problems are usually a serious matter and must be handled appropriately so it’s important to that you’ve hired the best lawyer for your particular situation. The tax attorneys at the Law Offices Of Jeffrey B. Kahn, P.C. located in Orange County (Irvine), Metropolitan Los Angeles (Long Beach and Ontario) and elsewhere in California are highly skilled in handling tax matters and can effectively represent at all levels with the IRS and State Tax Agencies including criminal tax investigations and attempted prosecutions, undisclosed foreign bank accounts and other foreign assets, and unreported foreign income. Also if you are involved in cannabis, check out what our cannabis tax attorneys can do for you.

Follow

Follow Follow

Follow