Tips For Cannabis Businesses To Prepare for Tax Season And IRC Sec. 280E

On January 6, 2020, the Internal Revenue Service (IRS) announced that it will process 2019 tax returns beginning January 27, 2020.

April 15th Filing Deadline.

The filing deadline to submit 2019 tax returns is Wednesday, April 15, 2020.

Since the IRS will begin processing tax returns on January 27th there is no advantage to filing tax returns on paper in early January instead of waiting for the IRS to begin accepting e-filed returns. Nevertheless, it makes sense to start organizing your information early and so when the IRS filing systems open on January 27th, you are ready to submit your tax return right away.

Yes – Cannabis Businesses Have to Report Income To IRS And Pay Taxes!

While the sale of cannabis is legal in California as well as in a growing number of states, cannabis remains a Schedule 1 narcotic under Federal law, the Controlled Substances Act. As such businesses in the cannabis industry are not treated like ordinary businesses. Despite state laws allowing cannabis, it remains illegal on a federal level but cannabis businesses are obligated to pay federal income tax on income because I.R.C. §61(a) does not differentiate between income derived from legal sources and income derived from illegal sources.

Additionally, while businesses can deduct ordinary and necessary business expenses under IRC Sec. 162, Under IRC Sec. 280E, taxpayers cannot deduct any amount for a trade or business where the trade or business consists of trafficking in controlled substances…which is prohibited by Federal law. What this means is that dispensaries and other businesses trafficking in cannabis have to report all of their income and cannot deduct rent, wages, and other expenses, making their marginal tax rate substantially higher than most other businesses.

A cannabis business can still deduct its Cost Of Goods Sold (“COGS”). Cost of goods sold are the direct costs attributable to the production of goods. For a marijuana reseller this includes the cost of cannabis itself and transportation used in acquiring cannabis. To the extent greater costs of doing business can be legitimately included in COGS that will that result in lower taxable income.

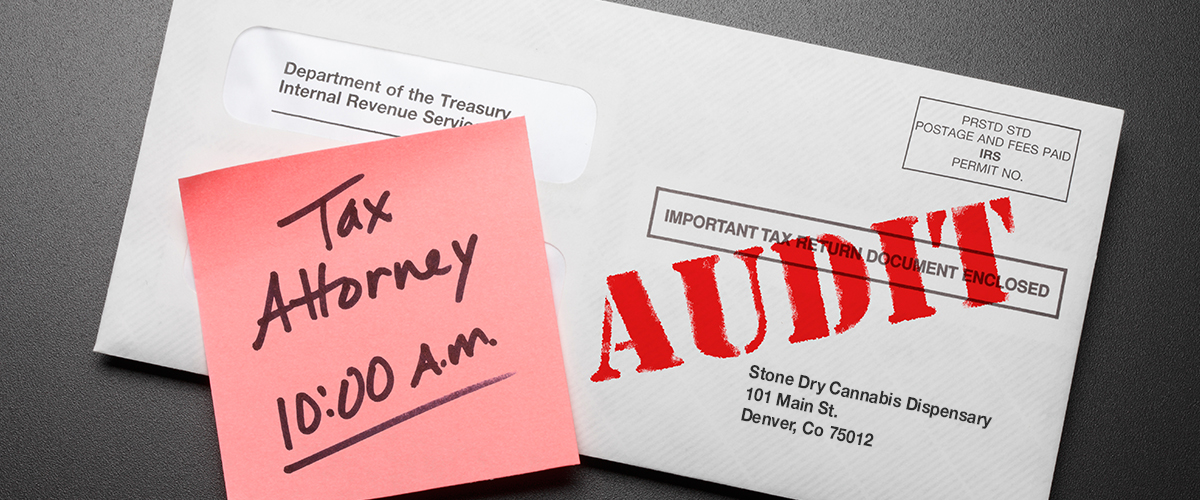

I.R.C. Section 280E IRS Tax Audits

It is no surprise that cannabis businesses are proliferating as more States legalize cannabis and make available licenses to grow, manufacture, distribute and sell cannabis. The IRS recognizes this and it is making these cannabis businesses face Federal income tax audits. IRC Sec. 280E is at the forefront of all IRS cannabis tax audits and enforcement of Sec. 280E could result in unbearable tax liabilities.

Proving deductions to the IRS is a two-step process:

- First, you must substantiate that you actually paid the expense you are claiming.

- Second, you must prove that an expense is actually tax deductible.

Step One: Incurred And Paid The Expense.

For example, if you claim a $5,000 purchase expense from a cannabis distributor, offering a copy of a bill or an invoice from the distributor (if one is even provided) is not enough. It only proves that you owe the money, not that you actually made good on paying the bill. The IRS accepts canceled checks, bank statements and credit card statements as proof of payment. But when such bills are paid in cash as it typical in a cannabis business, you would not have any of these supporting documents but the IRS may accept the equivalent in electronic form.

Step Two: Deductibility Of The Expense.

Next you must prove that an expense is actually tax deductible. For a cannabis businesses this is challenging because of the I.R.C. §280E limitation; however a cannabis business can still deduct its Cost Of Goods Sold (“COGS”). Cost of goods sold are the direct costs attributable to the production of goods.

For a cannabis reseller this includes the cost of cannabis itself and transportation used in acquiring cannabis. To the extent greater costs of doing business can be legitimately included in COGS that will that result in lower taxable income. You can be sure the IRS agents in audits will be looking closely at what is included in COGS.

Tips For Cannabis Tax Return Preparation

Here are some tips for cannabis businesses to follow in the preparation of their 2019 tax returns.

- Reconcile Your Books Before Closing Your Books. Incomplete books can cause delays and add unnecessary complexities.

- Utilize A Cannabis Tax Professional. Engage a tax professional who has experience in the cannabis industry. Such a professional would be familiar with the intricacies of IRC Sec. 280E and relevant cases to make the proper presentation on the tax return in a manner that would support the smaller tax liability possible.

- Justify Your Numbers As If An IRS Audit Is A Certainty. Don’t wait to receive a notice from IRS that the tax return is selected for examination. That can be one or two years away. Instead make it a point to put together the backup to you numbers now while everything is fresh.

Time Limits For Keeping Your Tax Records

Even though your 2019 income tax return is processed by the IRS and a refund is issued, that does not mean the IRS can later question or audit the tax return, In fact the Statute Of Limitations allows the IRS three years to go back and audit your tax return. That is why it’s a good idea to keep copies of your prior-year tax returns and supporting backup documentation for at least three years.

What Should You Do?

You know that at the Law Offices Of Jeffrey B. Kahn, P.C. we are always thinking of ways that our cannabis clients can save on taxes, minimize the impact of IRC Sec. 280E and limit audit risk. The cannabis tax attorneys and professionals at the Law Offices Of Jeffrey B. Kahn, P.C. located in Orange County (Irvine), the Inland Empire (including Ontario and Palm Springs) and elsewhere in California are highly skilled in handling cannabis tax matters and can effectively represent at all levels with the IRS and State Tax Agencies. Also if you are involved in crypto-currency, check out what a Bitcoin tax attorney can do for you.

Follow

Follow Follow

Follow