Jeffrey B. Kahn, Esq. and Windus A. Fernandez Brinkkord Discusses Business Consulting, 401(k) Plans and IRS Audits -What Need To Know, On ESPN Radio – August 12, 2016 Show

Jeffrey B. Kahn, Esq. and Windus A. Fernandez Brinkkord Discusses Business Consulting, 401(k) Plans and IRS Audits -What Need To Know, On ESPN Radio – August 12, 2016 Show

Topics Covered:

- Special Guest Chuck Hunter, CEO at Multivariable Solutions

- 401(k) Plans

- IRS Tax Audits – What You Need To Know

- Questions:

- What exactly are the pros and cons of leaving my 401(k) with my previous employer?

- How accurate are the do-it-yourself type software that allow you to calculate and file your taxes after answering a few questions? Why is it more beneficial to have a tax professional prepare your taxes as oppose to said software?

Jeff states: Good afternoon! Yes sometimes we just have to take the money and run!

Welcome to Inside Advantage – Your Financial And Tax Radio Show.

This is Board Certified Tax Attorney, Jeffrey B. Kahn, the principal attorney of the Law Offices Of Jeffrey B. Kahn, P.C. and head of the KahnTaxLaw team.

Windus states:

And this is Licensed Financial Planner, Windus A. Fernandez Brinkkord, Senior Vice President Of Investments at Trilogy Financial Services.

You are listening to our weekly radio show where we talk everything about finances and taxes from the ESPN 1700 AM Studio in San Diego, California.

Jeff states:

When it comes to knowing tax laws and paying taxes, let’s face it — everyone in the U.S. is either in tax trouble, on their way to tax trouble, or trying to avoid tax trouble!

Windus states:

And whether you are on the rebound or flying high, we have the information you need to make sound financial decisions and map out your strategy for success.

Jeff states:

Our show is broadcasted each Friday at 2:00PM Pacific Time and replays are available on demand by logging into the KahnTaxLaw website at www.kahntaxlaw.com.

Jeff states:

For today’s show we have coming up:

Segment 2 material: 401(k) Plans

Windus states:

Also coming up is:

Segment 3 material: IRS Tax Audits and What You Should Be Aware Of

And of course towards the end of our show, we will be answering some of your questions.

Jeff starts chit chat with Windus.

Jeff states: So for today’s special guest:

We would like to introduce Chuck Hunter! Chuck is the Founder and CEO of Multivariable Solutions, a domestic and international Business Consulting Firm located here in the Greater San Diego area.

- So Chuck, tell us a little bit about what you do?

- What is your goal or mission at Multivariable Solutions?

- What prompted you to found your own company?

- What would you say your niche market is? What types of companies tend to come to you the most, whether it’s based on size, growth goals, or various sectors…

- How long have you been with Multivariable Solutions? What had you done in your career before that prepared you to take on the role of CEO?

- Most companies and consultants focus on one or two variables whereas Multivariable Solutions looks across a wide spectrum. What exactly do you look for?

Jeff states: Well it’s time for a break but stay tuned because we are going to tell you all about 401(k) Plans.

You are listening to Board Certified Tax Attorney, Jeffrey B. Kahn, and Licensed Financial Planner, Windus A. Fernandez Brinkkord on Inside Advantage on ESPN.

BREAK

Welcome back. This is Inside Advantage – Your Financial And Tax Radio Show on ESPN and you are listening to Board Certified Tax Attorney, Jeffrey B. Kahn, and Licensed Financial Planner, Windus A. Fernandez Brinkkord.

And be aware of the special offer that Windus has for you: Windus PLUG: Trilogy Financial Services will provide you with a retirement cash flow analysis which is a $600.00 value for free as long as you mention the Inside Advantage Radio Show when you call to make an appointment. Call my office to make an appointment to meet with me, Windus A. Fernandez Brinkkord. The number to call is 858.314.5169. That is 858.314.5169. Or visit www.guideyourstory.com. NPC DOES NOT PROVIDE TAX NOR LEGAL ADVICE.

401(k) Plans

Some states, including California, are implementing regulation requiring companies of 5 or more people to offer retirement plans. In California, this is called the Retirement Savings Trust Act. The reason this is being required is:

The California State Treasurer states that based on their research fewer than 45% of California’s private workforce has access to a work sponsored retirement plan in the age group of 25-64. This is worse than the nationwide average of 53%. This is specifically only in the public sector.

To go a step further, in the public and private sectors, nearly ½ of all Californian’s are currently on track to retire with income below 200% of the federal poverty level of $22,000 per year for one person. *This information is coming from Trinet, an HR retirement planning company’s site. Trinet is one of many companies that help work on this here in San Diego.

The Secure Choice Retirement Savings is where companies that do not set up a plan of their own, will have to direct employees. The scary part of this is that for the first three years contributions could be kept in Treasury bills, regardless of your age, until more extensive models can be built! Better to have a large company like Fidelity or T. Rowe Price manage this then to have the treasurer put together a board that is going to take 3 years to put proper investment models in place.

*Chuck, with the work that you do, do you recommend companies start plans for their employees? When you do, what type of plans do you typically recommend?

There is also a new emerging “robo” 401k platform employers can implement. I have to say, when reading about this, a 401k plan is not the place for “robo” implementation. I can tell you that the IRS could have a field day auditing plans that are incorrectly established and 401k plans need to be very specific to the company.

Here are some main points for plans to remember:

*Employees with plan balances of under $5,000 can be forced out of the plan

*The fund line up should be reviewed on a schedule and there should be defined parameters for which funds are brought into the plan and removed from the plan.

*401k plans are required to have a diverse line up for employees to select from.

*Target date funds are becoming more popular and are often now the QDIA

*QDIA is the Qualified Default Investment for when an employee is auto enrolled in the plan but does not go in after to elect an allocation.

*Why might an employer elect to do auto enrollment?…because they want to contribute themselves without actually matching! J

Why a 401k plan over a SIMPLE plan.

*401k plans allow for employers to be selective about who is in the plan and match in a more creative fashion. Sometimes in a benefit to the employee and sometimes not. SIMPLE plans are “simpler” to maintain annually BUT they aren’t always on the best platforms for the employee and some have fees that just aren’t that transparent or favorable. The 401k plan can be a very powerful tool and if put in place correctly, can be very inexpensive to the employee for long term retirement savings. And in case anyone out there receives a 403 b 2 notice, THIS IS a key notice regarding the fees you pay in the 401k plan.

Top Company 401k plan issues:

- Not removing or encouraging x-employees to rollover their funds

2. Too much company stock or TOO much risk options without enough conservative options for employees.

3. Not remitting money in a timely fashion

4. Being “top heavy” having to force money out of the plan for your top employees. Being Top heavy means earning more than $120,000 in income or being more than a 5% owner in the company.

Windus PLUG: Trilogy Financial Services will provide you with a retirement cash flow analysis which is a $600.00 value for free as long as you mention the Inside Advantage Radio Show when you call to make an appointment. Call my office to make an appointment to meet with me, Windus A. Fernandez Brinkkord. The number to call is 858.314.5169. That is 858.314.5169. Or visit www.guideyourstory.com. NPC DOES NOT PROVIDE TAX NOR LEGAL ADVICE.

Stay tuned because after the break we are going to tell you IRS Tax Auditing and What You Should Be Aware Of.

You are listening to Board Certified Tax Attorney, Jeffrey B. Kahn, and Licensed Financial Planner, Windus A. Fernandez Brinkkord on Inside Advantage on ESPN.

BREAK

Jeff states: Welcome back. This is Inside Advantage – Your Financial And Tax Radio Show on ESPN and you are listening to Board Certified Tax Attorney, Jeffrey B. Kahn, and Licensed Financial Planner, Windus A. Fernandez Brinkkord.

Calling into the studio from my Walnut Creek Office is my associate attorney, Amy Spivey.

Chit chat with Amy

And be aware of the special Offer that I have for you: PLUG: The Law Offices Of Jeffrey B. Kahn, P.C. will provide you with a Tax Resolution Plan which is a $500.00 value for free as long as you mention the Inside Advantage Radio Show when you call to make an appointment. Call my office to make an appointment to meet with me, Jeffrey Kahn, right here in San Diego or at one of my other offices close to you. The number to call is 866.494.6829. That is 866.494.6829.

Jeff states: So I don’t know of anyone who enjoys being audited by the IRS. The IRS randomly selects tax returns for audit each year.

Jeff asks: Amy can you go over the deadlines that the IRS has if looking to audit a tax return?

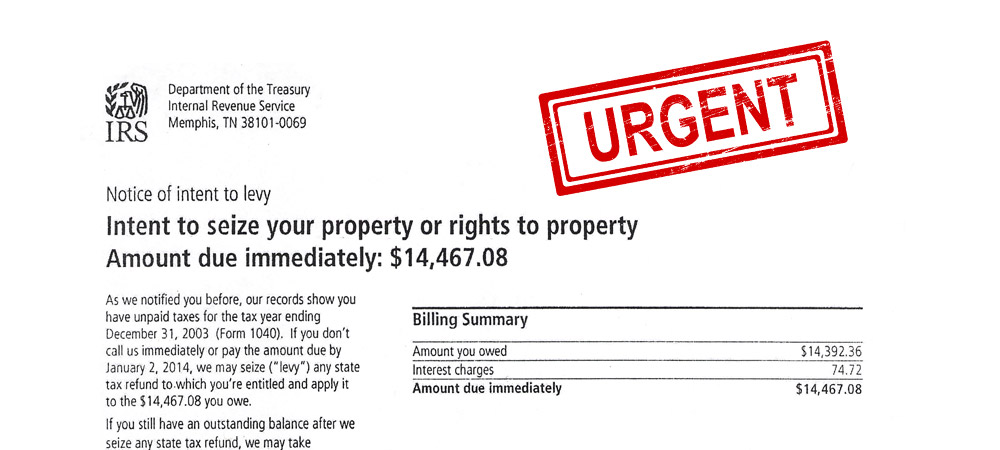

Amy replies: Now the IRS does have a deadline by which they must complete an audit of your tax return. Normally that deadline is three years after the due date of the tax return. So a 2013 income tax return that was filed by the April 15, 2014 filing deadline, the IRS would have until April 15, 2017 to audit that tax return.

Jeff states: Well here we are August 12, 2016 but do not relax so quickly. If you filed an extension for your 2013 tax income return, then you just extended the IRS’ time to audit to October 15, 2017.

Windus asks: Could the government have an even longer time to audit a tax return?

Amy replies: The government has an even longer time of six years where you omitted more than 20% of your income on your tax return and if you never filed a tax return or you filed a fraudulent tax return, there is no deadline for the government and you can be audited any time!

Windus asks: Amy, what are the different types of audits that the IRS conducts?

[Amy responds allowing Jeff to comment before proceeding to the next.]

Correspondence Audit: This is the least severe type of audit. It involves the IRS sending a letter in the mail requesting more information about part of a tax return. For instance, the agency may have questions regarding charitable deductions and request you send in receipts to substantiate your deduction. “It’s the lowest level of the audits.” “If you have the receipts or information it’s generally not an issue.” If your tax return is legitimate and you have the data to back up any claims on your return, you may want to handle the situation on your own. BUT If you don’t have the receipts or information, then you should have a tax representation professional deal with the IRS because you could face fines, penalties and interest if you end up owing money.

Office Audit: If the IRS has more questions about your return, then you’ll get a letter in the mail inviting you into an IRS office for the audit. The office audit is more serious, so you should always have a tax representation professional to come with you or turn over the audit representation to him. A tax representation professional can gather information in advance of the meeting and make sure it is complete so that the office audit can be wrapped up with the IRS as quickly as possible. “If the IRS still needs additional records, you’ll have time to supply the missing information.”

Field Audit: This is the most serious type of audit and involves the IRS visiting you at your home or office. “The reason the field audit is more serious is the IRS auditor will ask to see other things.” “They don’t want to limit it to particular items.” While there are much fewer field audits than office or correspondence audits, I wouldn’t let any client go into a field audit without representation. “It’s the most serious level of audit. If they are coming out to you, they are looking for something.”

Jeff states: So everyone wants to know, what sets off alarms at the IRS? Well for one thing it pays to keep in mind these 10 “red flags” that could increase the chance you’ll be targeted for an audit.

[Windus to read off each flag followed by Amy explanation and Jeff comment.]

- High income. The audit rate for 2011 tax returns, which was about 1.11% overall, shot to 3.93% for taxpayers with income of $200,000 or more. That’s almost one out of every 25 returns. The IRS tends to chase the “big money,” and while that’s no reason to earn less, you should realize that higher income exposes you to a greater audit risk.

- Unreported income. The IRS computers match up the income listed on W-2 and 1099 forms with the income reported on individual returns. You’re likely to draw IRS scrutiny if you don’t report all of your taxable income or if you underreport the total, even if an omission is inadvertent. Check your tax forms to ensure the information is correct.

- Large charitable gifts. Besides providing personal satisfaction, deductions for charitable gifts can offset highly taxed income on your return. But the IRS may become suspicious if the amount you deduct is disproportionate to your income. In particular, make sure that deductions for gifts of property are legitimate and include an independent appraisal when required.

- Home office deductions. If you qualify, you can write off your direct costs of using part of your home as an office, plus a percentage of everyday living expenses such as property taxes, mortgage interest, utilities, phone bills, insurance, etc. But the basic rule is that you must use the office “regularly and exclusively” as your principal place of business. Simply doing work at home when your main office is elsewhere won’t cut it.

- Rental real estate losses. Generally, “passive activity” rules prevent investors from deducting losses on rental real estate. But a special exception allows a loss deduction of up to $25,000 for “active participants,” subject to a phase-out between $100,000 and $150,000 of adjusted gross income (AGI). Another exception applies to qualified real estate professionals. The IRS may zero in on taxpayers claiming losses under either exception. This aspect of the tax law can get very technical so you should inquire with a tax professional to see if you qualify.

- Travel and entertainment expenses. This is often a key audit target. IRS agents particularly look for self-employed individuals and other business owners who claim unusually large write-offs for travel and entertainment expenses and meals. Note that the tax law includes strict substantiation rules that must be followed in order to deduct any of these expenses.

- Business use of cars. Another area ripe for abuse by taxpayers is the use of a vehicle for business purposes. The annual amount you can claim via depreciation deductions for the vehicle, based on percentage of business use, is limited by so-called “luxury car” rules. IRS agents have been trained to ferret out taxpayer records that don’t measure up. Another red flag is a claim for 100% business use of a vehicle, especially if another vehicle isn’t available for personal use.

- Hobby losses. As a general rule, you can deduct expenses for a hobby only up to the amount of the income it produces. You normally can’t claim a loss for the activity, unless your involvement rises to a level of a bona fide business. Usually, an activity is presumed not to be a hobby if you show a profit in any three out of the past five years, but the IRS can refute this presumption.

- Foreign bank accounts. The IRS has started clamping down on taxpayers with offshore accounts in “tax havens” in which banks do not disclose account information. Failure to report foreign income can trigger steep penalties and interest. If you have foreign bank accounts, make sure you properly report the income when you file your return.

- Cash businesses. If you operate a small business in which you’re largely paid in cash—for example, if you own a car wash, restaurant or bar, or a hair or nail salon—the IRS is more likely to examine your return. Past history indicates that cash-heavy taxpayers may underreport their income or, in some cases, not report any income at all. Accordingly, the IRS remains on high alert.

Jeff states: These red flags don’t mean you should shy away from claiming the tax breaks you rightly deserve. But when the IRS knocks on your door you need to be prepared. Which is why …

PLUG: The Law Offices Of Jeffrey B. Kahn, P.C. will provide you with a Tax Resolution Plan which is a $500.00 value for free as long as you mention the Inside Advantage Radio Show when you call to make an appointment. Call my office to make an appointment to meet with me, Jeffrey Kahn, right here in San Diego or at one of my other offices close to you. The number to call is 866.494.6829. That is 866.494.6829.

Thanks Amy for calling into the show. Amy says Thanks for having me.

Stay tuned as we will be taking some of your questions. You are listening to Board Certified Tax Attorney, Jeffrey B. Kahn, and Licensed Financial Planner, Windus A. Fernandez Brinkkord on Inside Advantage on ESPN.

BREAK

Jeff states: Welcome back. This is Inside Advantage – Your Financial And Tax Radio Show on ESPN and you are listening to Board Certified Tax Attorney, Jeffrey B. Kahn, and Licensed Financial Planner, Windus A. Fernandez Brinkkord.

And Windus and I always pleased to make our offers to our listeners where… PLUG: The Law Offices Of Jeffrey B. Kahn, P.C. will provide you with a Tax Resolution Plan which is a $500.00 value for free as long as you mention the Inside Advantage Radio Show when you call to make an appointment. Call my office to make an appointment to meet with me, Jeffrey Kahn, right here in San Diego or at one of my other offices close to you. The number to call is 866.494.6829. That is 866.494.6829.

Windus states: Windus PLUG: Trilogy Financial Services will provide you with a retirement cash flow analysis which is a $600.00 value for free as long as you mention the Inside Advantage Radio Show when you call to make an appointment. Call my office to make an appointment to meet with me, Windus A. Fernandez Brinkkord. The number to call is 858.314.5169. That is 858.314.5169. Or visit www.guideyourstory.com. NPC DOES NOT PROVIDE TAX NOR LEGAL ADVICE.

You should also know that the securities and advisory services are offered through National Planning Corporation (NPC) Member FINRA, SIPC, and a Registered Investment Advisor. Trilogy Financial Services and NPC are separate and unrelated Entities.

Jeff states: And again I would like to thank our special guest, Chuck Hunter, CEO at Multivariable Solutions for being on the show today. Chuck as our special guest you have the honors of drawing the questions from our listeners for us to answer. OK Chuck, what questions have you pulled for us to answer?

Question: What exactly are the pros and cons of leaving my 401(k) with my previous employer?

Windus answers.

Question: How accurate are the do-it-yourself type software that allow you to calculate and file your taxes after answering a few questions? Why is it more beneficial to have a tax professional prepare your taxes as oppose to said software?

Jeff answers.

Jeff states: Well we are reaching the end of our show.

Windus states: Have a great day everyone!

Follow

Follow Follow

Follow