KAHNTAXLAW CORONAVIRUS RESOURCE CENTER

The Law Offices Of Jeffrey B. Kahn, P.C. is here to help by providing pertinent information concerning coronavirus (COVID-19) to our clients and friends during these challenging times. Check out the KahnTaxLaw Coronavirus Resource Center for the latest information that can benefit you and your business.

Given the disruption and precautions we are experiencing with COVID-19 our office has implemented options to support social distancing by setting up sessions with Jeff via (1) video conference, or (2) facetime or standard telephone. Should you choose either option, any relevant documents you would like Jeff to review should be sent to Jeff in advance. Under either option, you would still have the same amount of time and level of attention as if this was a face-to-face meeting.

IRS Announces New COVID Tax Relief!

IRS Continues To Expand Tax Relief From COVID

Oral CBD Found to Inhibit COVID-19 Infection in Humans

IRS Announces New COVID Tax Relief!

IRS Continues To Expand Tax Relief From COVID

How COVID-19 And Underfunding Impacts IRS Operations And Causes Refund Delays For Taxpayers.

Tax Planning in 2021 – Make Sure You Are Getting All The Economic Stimulus And Tax Credits You Deserve From Tax Law Changes

Don’t Think That COVID-19 Masks Illicit Cannabis Operators From Enforcement

Living In The Era Of COVID-19 – Business Meals May Be Fully Deductible

More COVID-19 Tax Relief: IRS extends additional tax deadlines for individuals to May 17 and affirms deductibility of PPE

“Tax Day” For Individuals To File And Pay Extended To May 17, 2021.

Tax Relief During COVID-19: How taxpayers struggling with tax debts can benefit.

Where Is My IRS Second Economic Impact Payment?

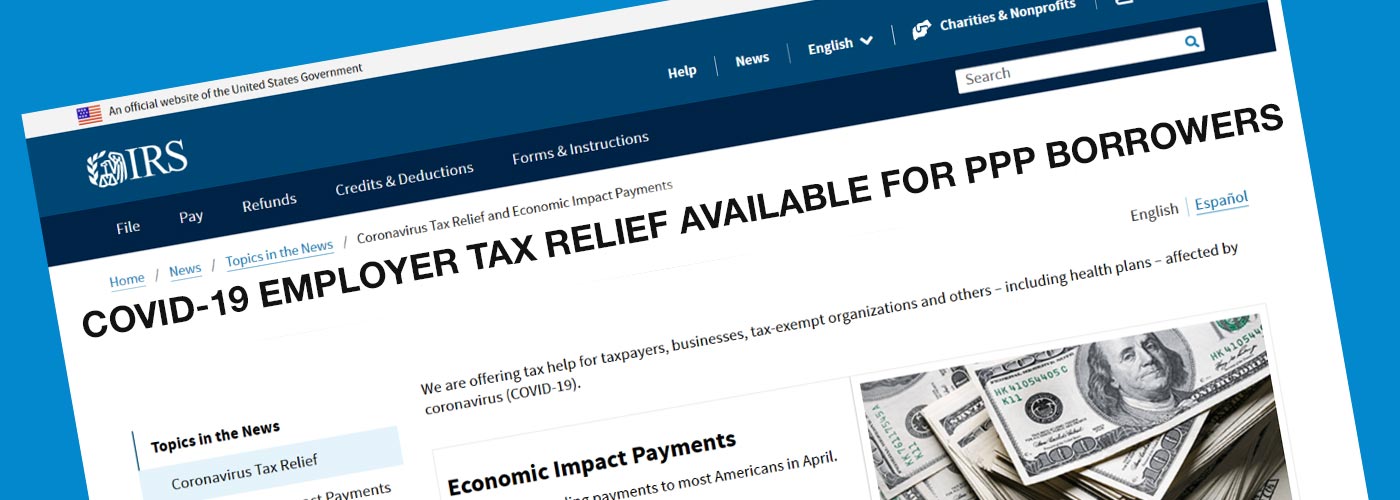

More Guidance From IRS On PPP Loans: Deductibility of Expenses Where a Business Received a PPP Loan

Attention College Students: Do Not Miss Out On Your Economic Impact Payment

More Guidance From IRS On PPP Loans: Lenders Should Not File Form 1099-C for Forgiven PPP loans

9 Million Non-filers To Receive Letter From The IRS Urging Them To Claim The Economic Impact Payment

IRS Takes New Steps For 50,000 Spouses To Get “Catch-up” Economic Impact Payments

IRS Takes New Steps To Ensure People With Children Receive $500 Economic Impact Payments

Beware That Soon IRS Will Be Unleashed And Fully Operational

California Responding To COVID-19 With Relief For Cannabis Businesses

Paycheck Protection Program Changes Are Here!

U.S. Attorney’s Office Files Charges In Rhode Island Against Two Borrowers Alleging Fraud In Seeking Paycheck Protection Loans

What To Do If Your Economic Impact Payment Is Wrong

Still Waiting For Your IRS Economic Impact Payment?

Emergency Cannabis Small Business Health and Safety Act Introduced In Congress – If You Can’t Beat Them, Then Join Them!

COVID-19 Tax Relief: California Delays Sales Tax Payments For Small Businesses

COVID-19 Employer Tax Relief Available for PPP Borrowers

Beware Of Unsupported Claims That Cannabis Or CBD Products Will Protect Or Cure You From Coronavirus

IRS Announces Temporary Procedures To Fax Forms 1139 And 1045 Due To COVID-19

https://www.kahntaxlaw.com/wp-content/uploads/2020/04/Where-Is-My-IRS-Economic-Impact-Payment.jpg

500

1400

Tax Attorney

https://www.kahntaxlaw.com/wp-content/uploads/2016/04/Tax-Attorney-Jeffrey-B-Kahn-Tax-IRS-Lawyer-CA-LA-1.jpg

Tax Attorney2020-04-10 13:59:132020-04-20 14:52:20Where Is My IRS Economic Impact Payment?

https://www.kahntaxlaw.com/wp-content/uploads/2020/04/Where-Is-My-IRS-Economic-Impact-Payment.jpg

500

1400

Tax Attorney

https://www.kahntaxlaw.com/wp-content/uploads/2016/04/Tax-Attorney-Jeffrey-B-Kahn-Tax-IRS-Lawyer-CA-LA-1.jpg

Tax Attorney2020-04-10 13:59:132020-04-20 14:52:20Where Is My IRS Economic Impact Payment?

A Tax Benefit In The COVID-19 Stimulus Package Available To Cannabis Businesses

IRS Continues To Expand Tax Relief From COVID-19

Canadian Cannabis Businesses Getting Their Share Of Canada’s COVID-19 Stimulus Package

Update To State Of California COVID-19 Tax Relief

Has Your Business Claimed Funds In The Paycheck Protection Program Under The Coronavirus Aid, Relief and Economic Security Act?

Cannabis Businesses Kept Out Of COVID-19 Stimulus Package

State Of California Responding To COVID-19 With Tax Relief

Does Smoking Cannabis Put You at Higher Risk for the Coronavirus?

How A Business Impacted By COVID-19 Claims The IRS Employee Retention Credit

How To Secure Funds In The Paycheck Protection Program Under The Coronavirus Aid, Relief and Economic Security Act

How Scammers Are Looking To Steal Your Economic Impact Payment Under The Coronavirus Aid, Relief and Economic Security Act

How To Claim Your Economic Impact Payment Under The Coronavirus Aid, Relief and Economic Security Act

Cannabis Businesses Deemed “Essential” in California Under COVID-19 Orders

Coronavirus Aid, Relief and Economic Security Act – Part 1: Individuals

Coronavirus Aid, Relief and Economic Security Act – Part 2: Businesses

IRS Responding To COVID-19 With “The IRS People First Initiative” For Examination And Collection Tax Relief

Federal & State Tax Agencies Responding To COVID-19 With Tax Relief – The Families First Coronavirus Response Act

Federal & State Tax Agencies Responding To COVID-19 With Tax Relief – Tax Day Officially Changed To July 15th

IRS Responding To COVID-19 With Tax Relief – Tax Day Officially Changed To July 15th

California Cannabis Businesses Coping With COVID-19

How Are Cannabis Businesses Coping With COVID-19?

Federal & State Tax Agencies Responding To COVID-19 With Tax Relief – IRS And Treasury Department Issues Initial Guidance

Federal & State Tax Agencies Responding To COVID-19 With Tax Relief

Follow

Follow Follow

Follow