Did You Receive IRS Notice LT16? What You Need To Do To Prevent An IRS Levy

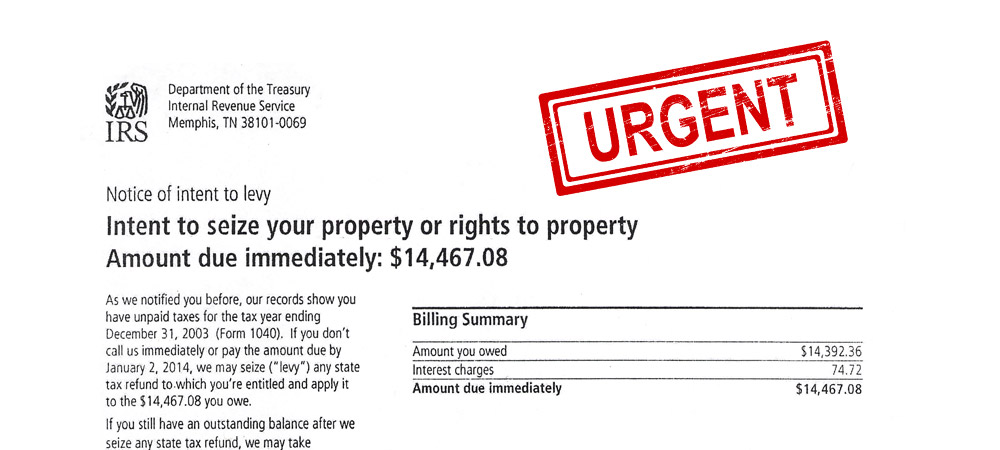

You just received IRS Notice LT16, warning that your unpaid taxes have been assigned for immediate enforcement action. It may not have been the first IRS notice you received but is this one you need to take seriously?

IRS Notice LT16 gives you three options:

- Within 10 days, send a check to the IRS to pay your taxes,

- Call the IRS to make payment arrangements, or

- Face the prospect of an IRS levy on your wages and property.

While IRS Notice LT16 appears threatening and intimidating (which is how the IRS designed this notice), this notice, standing alone, does not permit the IRS to levy your wages or seize your property.

Facts You Need To Know About IRS Notice LT16:

Before the IRS can levy your wages and property, they must first send you a Final Notice of Intent to Levy, identified as IRS Notice LT11. An IRS Notice LT16 is not an IRS Notice LT11, and does not carry the same legal weight.

The IRS has been known to send an IRS Notice LT16 before the IRS Notice LT11. When this happens – which could be your situation – the IRS Notice LT16 gives the IRS no power to levy. Even if this may be the case with you, the IRS Notice LT16 should still be taken seriously.

Steps You Need To Take:

After receiving an IRS Notice LT16, it is important to not blindly contact the IRS out of fear, but to first determine if an IRS Notice LT11 was ever sent. This will determine whether a response to IRS is needed right away to hold off imminent collection action. A review of all the IRS letters you have previously received would reflect whether an IRS Notice LT16 (Final Notice of Intent To Levy), distinguishing it from other similar IRS letters that appear to put you in jeopardy of levy but actually do not.

Since mail can be mis-delivered or lost, we do not rely on what a client may have received from the IRS but to be certain, we would contact the IRS and request account transcripts, which would reflect if the Final Notice of Intent To Levy was ever sent to you, and if so, when.

If an IRS Notice LT16 (Final Notice of Intent To Levy) was issued, it is imperative that contact be made to IRS as soon as possible to secure a collection hold on your account or if your case qualifies, to file an appeal with IRS Collections. Where an appeal is made, your account should be forwarded to the IRS Office Of Appeals who would assume jurisdiction over your case and consider any collection proposal made on behalf of the taxpayer. Depending on the type of appeal made and the periods covered in the appeal, it may also stop any further levy from occurring.

Prepare For The Day Of Reckoning.

Receiving an IRS Notice LT16 is often an indicator that the IRS is seeking active collection enforcement of your account. This could include transferring your case from an Automated Collection Service Center to a local Revenue Officer. Revenue Officers are IRS collection agents would work in or near your locale, and often start a collection case investigation by making a visit to your home or office.

If your account is already with a Revenue Officer and an IRS Notice LT16 is issued, any response should be made directly to the Revenue Officer who has been delegated by the IRS to oversee all collection efforts.

Knowing the ignorance of your IRS liabilities will only make things worse, you should utilize this time to get your financial information in order and make sure you are current with your tax filings and if required estimated tax payments. With the submission of proper and complete financial disclosures and evidence that you are in current compliance with tax filings and estimated tax payments, the IRS can consider your proposal. This could be to place you into an installment agreement, process an offer in compromise, or determine that you cannot afford to pay the taxes back, and place your account in currently uncollectible status.

What Should You Do?

It is important that you understand your rights when you receive an IRS Notice LT16 to know could happen next and to prepare for a permanent resolution that you can live with. Protect yourself and stand up to the IRS by getting representation. Tax problems are usually a serious matter and must be handled appropriately so it’s important to that you’ve hired the best tax attorney for your particular situation. The tax attorneys at the Law Offices Of Jeffrey B. Kahn, P.C. located in Orange County (Irvine), San Diego County (Carlsbad) and elsewhere in California are highly skilled in handling tax matters and can effectively represent at all levels with the IRS and State Tax Agencies including criminal tax investigations and attempted prosecutions, undisclosed foreign bank accounts and other foreign assets, and unreported foreign income.

Follow

Follow Follow

Follow