Law Offices Of Jeffrey B. Kahn, P.C. – Office Locations

Jeffrey B. Kahn, Board Certified Tax Attorney

Northern California Office Locations

EAST BAY – WALNUT CREEK OFFICE

1255 Treat Boulevard, Suite 300

Walnut Creek, CA 94597

Telephone: 925.979.9929

50 California Street, Suite 1500

San Francisco, CA 94111

Telephone: 415.543.4434

SILICON VALLEY – SAN JOSE OFFICE

2033 Gateway Place, Suite 500

San Jose, CA 95110

Telephone: 408.573.7377

Southern California Office Locations

15615 Alton Parkway, Suite 450

Irvine, CA 92618

Telephone: 949.724.0007

SOUTH LOS ANGELES – LONG BEACH OFFICE

111 West Ocean Blvd., Suite 400

Long Beach, CA 90802

Telephone: 310.215.9800

EAST LOS ANGELES – ONTARIO OFFICE

3200 East Guasti Road, Suite 100

Ontario, CA 91761

Telephone: 909.418.6800

SAN DIEGO COUNTY – CARLSBAD OFFICE

701 Palomar Airport Road, Suite 300

Carlsbad, CA 92011

Telephone: 619.237.0405

https://www.kahntaxlaw.com/wp-content/uploads/2018/09/affected-by-hurricane-damage-IRS-Relief.jpg

450

1000

Tax Attorney

https://www.kahntaxlaw.com/wp-content/uploads/2016/04/Tax-Attorney-Jeffrey-B-Kahn-Tax-IRS-Lawyer-CA-LA-1.jpg

Tax Attorney2018-09-17 07:56:192018-09-17 08:57:27Are You Effected By Hurricane Florence? IRS Is Providing You With Tax Relief And Extending Upcoming Tax Deadlines.

https://www.kahntaxlaw.com/wp-content/uploads/2018/09/affected-by-hurricane-damage-IRS-Relief.jpg

450

1000

Tax Attorney

https://www.kahntaxlaw.com/wp-content/uploads/2016/04/Tax-Attorney-Jeffrey-B-Kahn-Tax-IRS-Lawyer-CA-LA-1.jpg

Tax Attorney2018-09-17 07:56:192018-09-17 08:57:27Are You Effected By Hurricane Florence? IRS Is Providing You With Tax Relief And Extending Upcoming Tax Deadlines. https://www.kahntaxlaw.com/wp-content/uploads/2018/09/Crypto-trade-arrest.jpg

450

1000

Tax Attorney

https://www.kahntaxlaw.com/wp-content/uploads/2016/04/Tax-Attorney-Jeffrey-B-Kahn-Tax-IRS-Lawyer-CA-LA-1.jpg

Tax Attorney2018-09-17 07:27:262018-09-17 08:51:29Connecticut Crypto Currency Trader Convicted For Wire Fraud And Sentenced To 21 Months In Prison And Pay Restitution Of Over $9 Million.

https://www.kahntaxlaw.com/wp-content/uploads/2018/09/Crypto-trade-arrest.jpg

450

1000

Tax Attorney

https://www.kahntaxlaw.com/wp-content/uploads/2016/04/Tax-Attorney-Jeffrey-B-Kahn-Tax-IRS-Lawyer-CA-LA-1.jpg

Tax Attorney2018-09-17 07:27:262018-09-17 08:51:29Connecticut Crypto Currency Trader Convicted For Wire Fraud And Sentenced To 21 Months In Prison And Pay Restitution Of Over $9 Million.

OVDP Ending September 28, 2018

/

0 Comments

If you have undisclosed foreign bank accounts and/or unreported…

https://www.kahntaxlaw.com/wp-content/uploads/2018/09/IRS-LT-16-Notice-of-Levy.jpg

450

1000

Tax Attorney

https://www.kahntaxlaw.com/wp-content/uploads/2016/04/Tax-Attorney-Jeffrey-B-Kahn-Tax-IRS-Lawyer-CA-LA-1.jpg

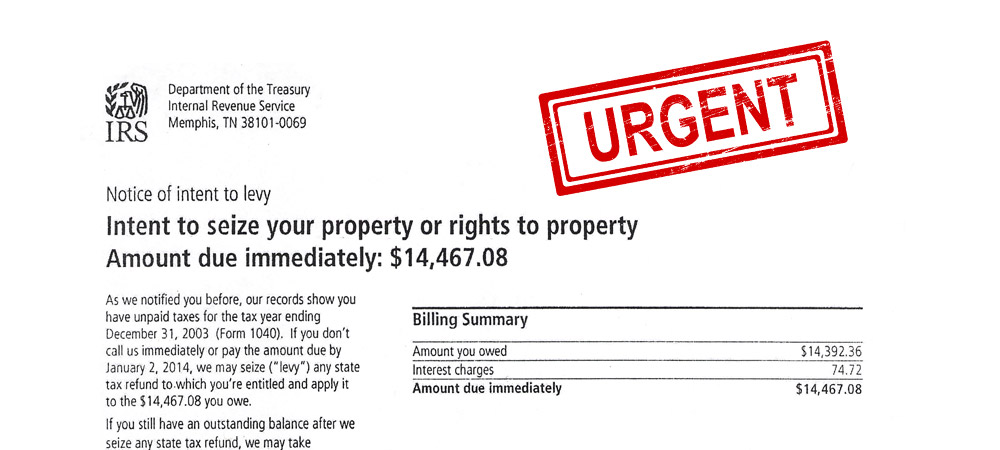

Tax Attorney2018-09-04 05:51:422018-09-04 06:22:21Did You Receive IRS Notice LT16? What You Need To Do To Prevent An IRS Levy

https://www.kahntaxlaw.com/wp-content/uploads/2018/09/IRS-LT-16-Notice-of-Levy.jpg

450

1000

Tax Attorney

https://www.kahntaxlaw.com/wp-content/uploads/2016/04/Tax-Attorney-Jeffrey-B-Kahn-Tax-IRS-Lawyer-CA-LA-1.jpg

Tax Attorney2018-09-04 05:51:422018-09-04 06:22:21Did You Receive IRS Notice LT16? What You Need To Do To Prevent An IRS Levy

San Diego Crypto Currency Trader Indicted And Held Without Bond In The U.S. For Money Laundering

Do not think that just because digital exchanges are not broker-regulated…

Got IRS Debt? Know When It’s Really The IRS Contacting You.

From time to time the IRS issues consumer warnings on the fraudulent…

https://www.kahntaxlaw.com/wp-content/uploads/2018/07/IRS-targeting-unreported-foreign-income-bank-accounts.jpg

450

1000

Tax Attorney

https://www.kahntaxlaw.com/wp-content/uploads/2016/04/Tax-Attorney-Jeffrey-B-Kahn-Tax-IRS-Lawyer-CA-LA-1.jpg

Tax Attorney2018-07-18 09:35:412018-07-18 11:04:25IRS Targeting Taxpayers With Unreported Foreign Income And Undisclosed Foreign Bank Accounts

https://www.kahntaxlaw.com/wp-content/uploads/2018/07/IRS-targeting-unreported-foreign-income-bank-accounts.jpg

450

1000

Tax Attorney

https://www.kahntaxlaw.com/wp-content/uploads/2016/04/Tax-Attorney-Jeffrey-B-Kahn-Tax-IRS-Lawyer-CA-LA-1.jpg

Tax Attorney2018-07-18 09:35:412018-07-18 11:04:25IRS Targeting Taxpayers With Unreported Foreign Income And Undisclosed Foreign Bank Accounts https://www.kahntaxlaw.com/wp-content/uploads/2018/07/crypto-trader-sentanced-to-prison.jpg

450

1000

Tax Attorney

https://www.kahntaxlaw.com/wp-content/uploads/2016/04/Tax-Attorney-Jeffrey-B-Kahn-Tax-IRS-Lawyer-CA-LA-1.jpg

Tax Attorney2018-07-16 07:32:392018-07-16 09:08:26Los Angeles Crypto Currency Trader Convicted For Money Laundering And Sentenced To One Year In Prison

https://www.kahntaxlaw.com/wp-content/uploads/2018/07/crypto-trader-sentanced-to-prison.jpg

450

1000

Tax Attorney

https://www.kahntaxlaw.com/wp-content/uploads/2016/04/Tax-Attorney-Jeffrey-B-Kahn-Tax-IRS-Lawyer-CA-LA-1.jpg

Tax Attorney2018-07-16 07:32:392018-07-16 09:08:26Los Angeles Crypto Currency Trader Convicted For Money Laundering And Sentenced To One Year In Prison https://www.kahntaxlaw.com/wp-content/uploads/2018/07/IRS-going-after-darknet-narcotics-vendors.jpg

450

1000

Tax Attorney

https://www.kahntaxlaw.com/wp-content/uploads/2016/04/Tax-Attorney-Jeffrey-B-Kahn-Tax-IRS-Lawyer-CA-LA-1.jpg

Tax Attorney2018-07-16 07:12:382018-07-16 09:07:00Darknet Narcotics Vendors Selling to Thousands of U.S. Residents Accused Of Tax Crimes

https://www.kahntaxlaw.com/wp-content/uploads/2018/07/IRS-going-after-darknet-narcotics-vendors.jpg

450

1000

Tax Attorney

https://www.kahntaxlaw.com/wp-content/uploads/2016/04/Tax-Attorney-Jeffrey-B-Kahn-Tax-IRS-Lawyer-CA-LA-1.jpg

Tax Attorney2018-07-16 07:12:382018-07-16 09:07:00Darknet Narcotics Vendors Selling to Thousands of U.S. Residents Accused Of Tax Crimes https://www.kahntaxlaw.com/wp-content/uploads/2018/07/IRS-investigates.jpg

450

1000

Tax Attorney

https://www.kahntaxlaw.com/wp-content/uploads/2016/04/Tax-Attorney-Jeffrey-B-Kahn-Tax-IRS-Lawyer-CA-LA-1.jpg

Tax Attorney2018-07-11 08:51:452018-07-11 10:30:52IRS Crackdown On Taxpayers Earning Income In The Sharing Economy

https://www.kahntaxlaw.com/wp-content/uploads/2018/07/IRS-investigates.jpg

450

1000

Tax Attorney

https://www.kahntaxlaw.com/wp-content/uploads/2016/04/Tax-Attorney-Jeffrey-B-Kahn-Tax-IRS-Lawyer-CA-LA-1.jpg

Tax Attorney2018-07-11 08:51:452018-07-11 10:30:52IRS Crackdown On Taxpayers Earning Income In The Sharing Economy https://www.kahntaxlaw.com/wp-content/uploads/2018/07/australia-crypto-tax.jpg

450

1000

Tax Attorney

https://www.kahntaxlaw.com/wp-content/uploads/2016/04/Tax-Attorney-Jeffrey-B-Kahn-Tax-IRS-Lawyer-CA-LA-1.jpg

Tax Attorney2018-07-10 06:29:302018-07-10 06:41:46Australia Follows The IRS Targeting Tax Evading Crypto Traders

https://www.kahntaxlaw.com/wp-content/uploads/2018/07/australia-crypto-tax.jpg

450

1000

Tax Attorney

https://www.kahntaxlaw.com/wp-content/uploads/2016/04/Tax-Attorney-Jeffrey-B-Kahn-Tax-IRS-Lawyer-CA-LA-1.jpg

Tax Attorney2018-07-10 06:29:302018-07-10 06:41:46Australia Follows The IRS Targeting Tax Evading Crypto Traders https://www.kahntaxlaw.com/wp-content/uploads/2018/06/silk-road-extradition.jpg

450

1000

Tax Attorney

https://www.kahntaxlaw.com/wp-content/uploads/2016/04/Tax-Attorney-Jeffrey-B-Kahn-Tax-IRS-Lawyer-CA-LA-1.jpg

Tax Attorney2018-07-09 11:23:172018-07-10 04:47:13Another Alleged Member Of “Operation Silk Road” Returning To The U.S. To Face Federal Charges

https://www.kahntaxlaw.com/wp-content/uploads/2018/06/silk-road-extradition.jpg

450

1000

Tax Attorney

https://www.kahntaxlaw.com/wp-content/uploads/2016/04/Tax-Attorney-Jeffrey-B-Kahn-Tax-IRS-Lawyer-CA-LA-1.jpg

Tax Attorney2018-07-09 11:23:172018-07-10 04:47:13Another Alleged Member Of “Operation Silk Road” Returning To The U.S. To Face Federal Charges

Follow

Follow Follow

Follow